Pablo Martín Losa BGI LAW | Madrid-España

16/12/2021

Commercial companies in Spain are regulated by Royal Legislative Decree 1/2010 of July 2, which approves the Consolidated Text of the Capital Companies Law (hereinafter, LSC). Said Law has an integrating character, due to the fact that it unified the Law by which the Public Limited Companies of 1989 were regulated, together with the Law of 1995, which contained the regulating regulations of the Limited Companies Law.

The LSC includes the following companies within the concept of capital companies: (i) the limited liability company; (ii) the public limited company and, lastly, (iii) the company limited by shares.

Each type of company contemplates different legal forms to be able to establish itself as a company, and they have all their peculiarities. Before making a decision on how to establish themselves, the partner/s must weigh and clearly define the following criteria: the corporate purpose, the economic activity that they are going to develop, the number of partners, the bylaws that will govern the relationship between them , as well as the applicable tax regime. The most demanded type of company in our country is the limited company, after entrepreneurship as an individual or self-employed person.

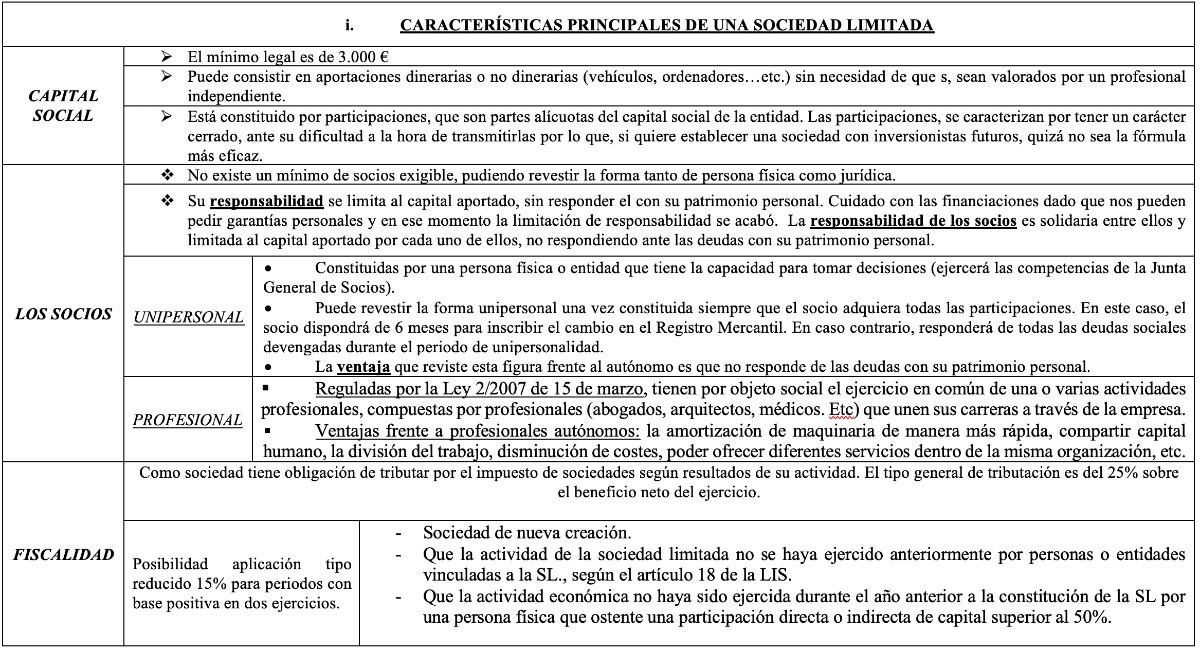

Among the characteristics that define a limited company, the following stand out, detailed in the following table:

A. SOCIAL FORMS OF THE LIMITED COMPANY:

Ø Limited Company under successive formation:

This type of company is normalized in the Entrepreneurs Support Law. The particularity of this is that it initially allows its share capital to be less than the required €3,000. A series of obligations must be fulfilled until the aforementioned capital is formalized:

o 20% of the profit for the year must be set aside as a legal reserve.

o Dividends can be distributed to partners when the net worth is greater than 60% of the minimum capital, once the legal reserves have been covered.

o The salary of partners and administrator may not exceed 20% of the net worth of the company.

o In the event of dissolution without having provided the minimum capital of €3,000, the partners are jointly and severally liable up to that amount, without prejudice to the fact that, subsequently, they may claim from each other the aliquot part of the individual participation.

o It is not necessary to accredit the monetary contributions of each partner in the constitution since they will be jointly and severally liable to the company and to third parties.

Ø New Company Company:

This type of company was based and created fundamentally for its telematic processing, which provided an advantage over other companies, such as the speed of its constitution.

Main features:

o Its partners must be natural persons and never exceed the number of five.

o The company name bears the name and surname of one of the partners followed by an identification code.

o The number of SLNEs in which a single person can be a member is limited.

o The maximum share capital cannot exceed €120,000.

o In addition, they have certain tax advantages such as the non-obligation to make corporate tax payments on account during the first two years, being able to split personal income tax payments during the first year, etc...

Ø Labor Limited Company

They are geared to be worker-controlled companies. The sale of shares is controlled, with non-member workers having preference over any person outside the company.

The requirements to be SLL are:

o More than 50% of the capital must be in the hands of workers with an indefinite contract.

o Each partner can only own 1/3 of the share capital, with exceptions.

o Indefinite-term employees who are not partners may not exceed, as a general rule, 49% of the working hours performed by partners with a fixed contract during a year.

As a tax benefit, we can prioritize the free depreciation of fixed assets acquired in the first five years of existence.

The notable advantages are:

o Benefit from the unemployment benefit in the event of cessation of activity for working partners and members of the administrative body as long as they have been contributing to the general social security scheme.

o Aid and subsidies aimed at this type of company.

On the contrary, decision-making is possible due to the presence of capitalist partners and worker partners with surely different goals. Likewise, they are obliged to endow a special reserve fund of 10% of the positive results of the activity.

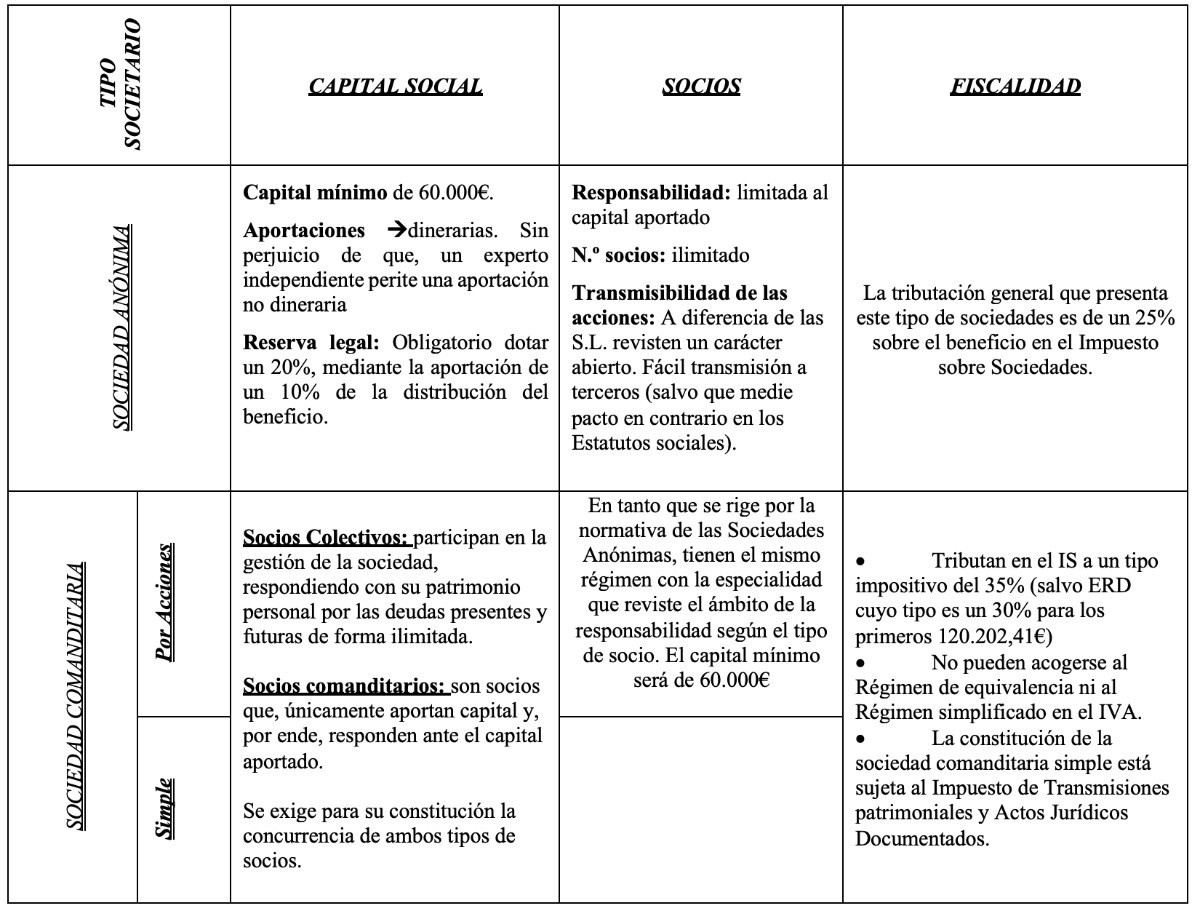

ii. THE LIMITED COMPANY AND THE COMPANY LIMITED BY SHARES

Another of the legal forms legislated by Royal Legislative Decree 1/2010 is the Public Limited Company and the limited partnership by shares whose most relevant characteristics are:

At Balms Abogados we have a great team of professionals, willing to help those who need it, in order to set up a company according to their needs.

LAST POSTS

Balms Abogados

24/10/2022The 12th Congress of the Spanish-Austrian Lawyers Association took place in Malaga on the 22nd of October.